are union dues tax deductible in 2020

Elected officials of the union set union dues and typically hover around 1-2. On smaller devices click the menu icon in the upper left-hand corner.

Union Professional And Other Dues For Medical Residents Md Tax

E-File your tax return directly to the IRS.

. Annual dues for membership in a trade union or an association of public servants. Under current federal law employee business expenses are generally not deductible. You cant deduct voluntary unemployment benefit fund contributions you make to a union fund or a private fund.

The NLRA allows unions and employers to enter into union-security agreements which require the payment of dues or dues. Taxpayer is clergy Now Im wondering just hypothetically whether union dues on a clergy return could be used as a deduction for self-employment tax. The amount of dues collected from employees represented by unions is subject to federal and state laws and court rulings.

Prepare federal and state income taxes online. Can I Deduct Union Dues Now. If youre self-employed you can deduct union dues as a business expense.

However you can deduct contributions as taxes if state law requires you to make them to a state unemployment fund that covers you for the loss of wages from unemployment caused by business conditions. This prohibition was written into the tax reform legislation passed by the US. The good news is that the end of the miscellaneous expenses deduction is not permanent yet.

Are union dues tax-deductible. Ad Easy Software To Help You Find All the Tax Deductions You Deserve. These are entered as unreimbursed employee expenses on Line 21 of Schedule A Form 1040 Itemized Deductions.

Theres talk of making some new tax laws longer term as part of Tax Reform 20. Miscellaneous itemized deductions are those deductions that would have. June 3 2019 1127 AM.

Educator expense tax deduction renewed for 2020 tax returns. Union dues may be tax deductible subject to certain limitations. The deduction would last through 2025.

And yes the clergy do have unions in Great Britain and Canada. Eligible educators can deduct up to 250 of qualified expenses you paid in 2020. If you and your spouse are filing jointly and.

Thanks to union victories the educator expense tax deduction has been renewed for 2020 returns - and theres a state deduction for your union dues too. Union Dues or Professional Membership Dues You Cannot Claim. Deduction of union dues.

We have printed a chart you can use to compute the amount deducted on your behalf and remitted to the UFT. That is the deductibility has been suspended for tax years 2018 through 2025 inclusive. That would be fun to explain to a programmer.

The short answer is that dues may not be subtracted from taxable income in the tax years 2018 through 2025. Symbolically however the tax deduction change sends a message at least to beleaguered union members. This publication explains that you can no longer claim any miscellaneous itemized deductions unless you fall into one of the qualified categories of employment claiming a deduction relating to unreimbursed employee expenses.

However if the taxpayer is self-employed and pays union dues those dues are deductible as a business expense. If you are an employee you can claim your union dues as a job-related expense if you itemize deductions. During the year ending Dec.

However the job-related expenses deduction is still available to people. 31 2021 the City of New York and other employers deducted union dues for the UFT from those UFT members who were so designated. Tax reform eliminated the deduction for union dues for tax years 2018-2025.

You cannot claim a tax deduction for initiation fees licences special assessments or charges not related to the operating cost of your company. Subscriptions to trade business or professional associations. There are however a few.

Restoring Balance in Albertas Workplaces Act 2020 Bill 32. I just did a return with Housing Allowance listed there. What are typical union dues.

Dues arent deducted until the worker signs paperwork that authorizes dues deduction and elects membership or fee paying status. Its scheduled for now to return in tax year 2026. You can only claim payments of levies to a strike fund where the funds sole use is to maintain or improve the contributors.

Professional board dues required under provincial or territorial law. The payment of a bargaining agents fee to a union for negotiations in relation to a new enterprise agreement award with your existing employer. Line 21200 was line 212 before tax year 2019.

This is in response to an email we received from Craig Mutter on November 23 2020 and our discussion of January 14 2021 DAngeloMutter asking whether legislative changes made in Albertas Bill 32. Claim the total of the following amounts that you paid or that were paid for you and reported as income in the year related to your employement. An employee business expense is generally defined as an expense paid by the employee for the purpose of carrying on a job with their employer or a business.

Whether union dues adversely affect household cash flow or not the question remains. Claiming union dues twice can result in a notice of reassessment and a possible penalty tax and interest owing. If you are self-employed you can enter your union dues as a Schedule C business expense.

To enter union dues in TaxAct. However most employees can no longer deduct union dues on their federal tax return in tax years 2018 through 2025 as a result of the Tax Cuts and Jobs Act TCJA that Congress signed into law on December 22 2017. From within your TaxAct return Online or Desktop click on the Federal tab.

You can deduct dues and initiation fees you pay for union membership. Union dues may be deductible from California income taxes if you qualify to itemize on your California tax return. Job-related expenses arent fully deductible as they are subject to the 2 rule.

For tax years 2018 through 2025 union dues and all employee expenses are no longer deductible even if the employee can itemize deductions. Furthermore you cannot claim a tax deduction. Early 2020 reports cited an average 38 salary increase in first contracts.

A reminder for tax season. Tax reform changed the rules of union due deductions. The chart below details Standard Dues Deductions Amounts for 2021 NEACTATALB dues.

In other words union dues would get the same treatment now reserved for things like insurance premiums and retirement contributions. Click here to download a copy of this document for print-out. Brigitte Richer 2020-087195.

Tax Deductions In 2020 And 2021 Money Zine Com

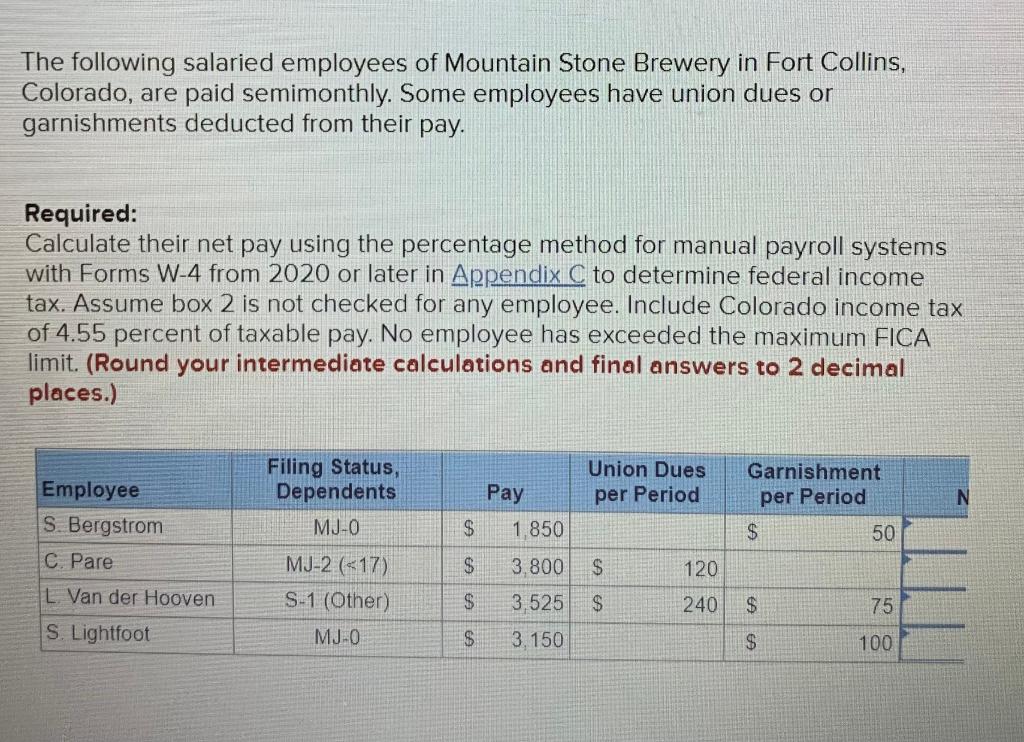

The Following Salaried Employees Of Mountain Stone Chegg Com

Are Jewish Temple Dues Tax Deductible Chicagojewishnews Com

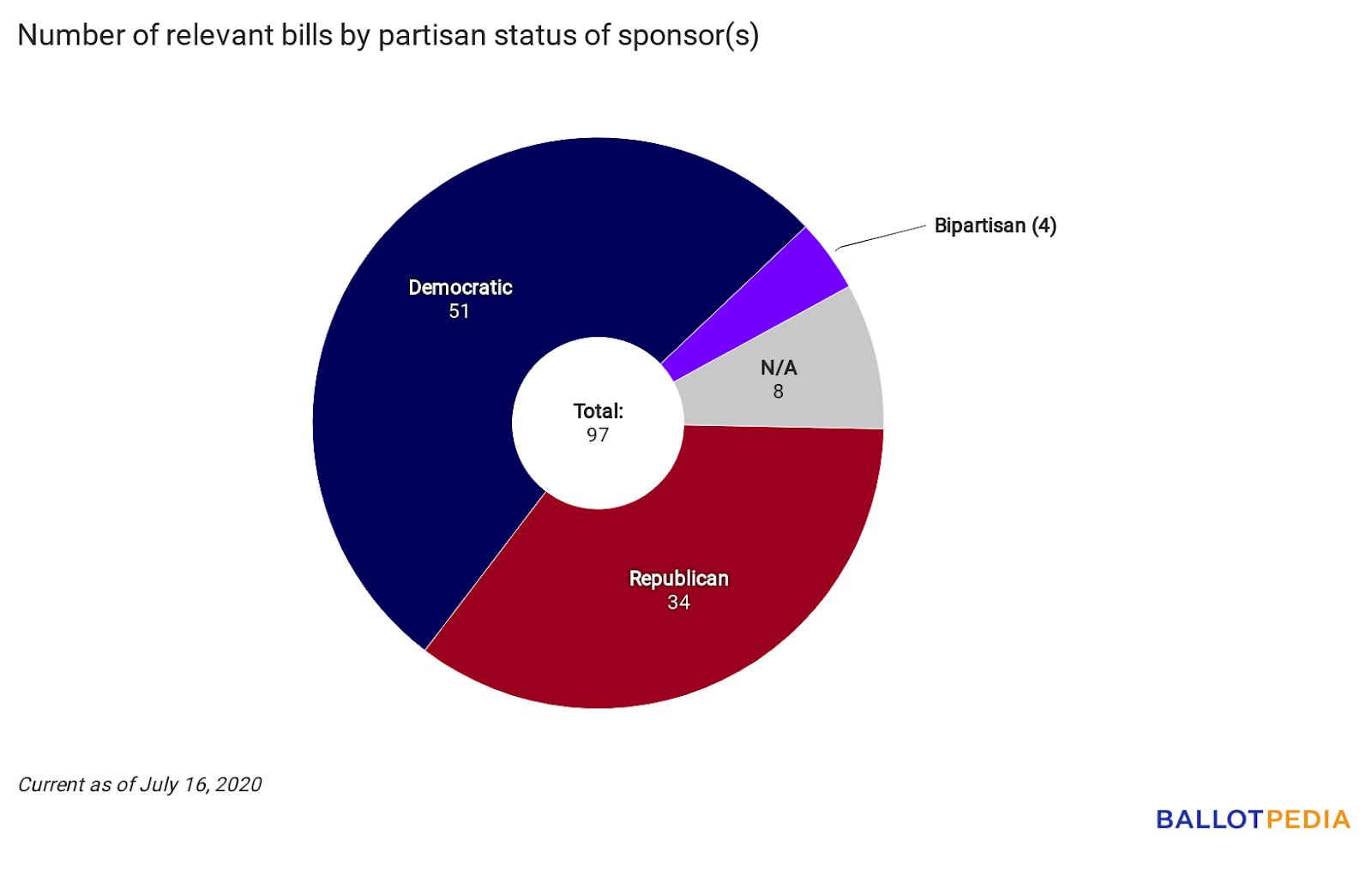

Michigan Civil Service Commission Approves Union Dues Deduction Rule Change Ballotpedia News

Solved Can We Still Deduct Electrical Union Dues And The Additional Work Assessment Fees That We Used To Itemize On Either Our Federal Return Or On The Minnesota Return

Membership Dues Tax Deduction Info Teachers Association Of Long Beach

/MostOverlookedTaxDeductions-29f2eea9bc044c90b9f5593fb267005a.jpg)

The Most Overlooked Tax Deductions

Solved Pls Help Thank You Taxation Course Hero

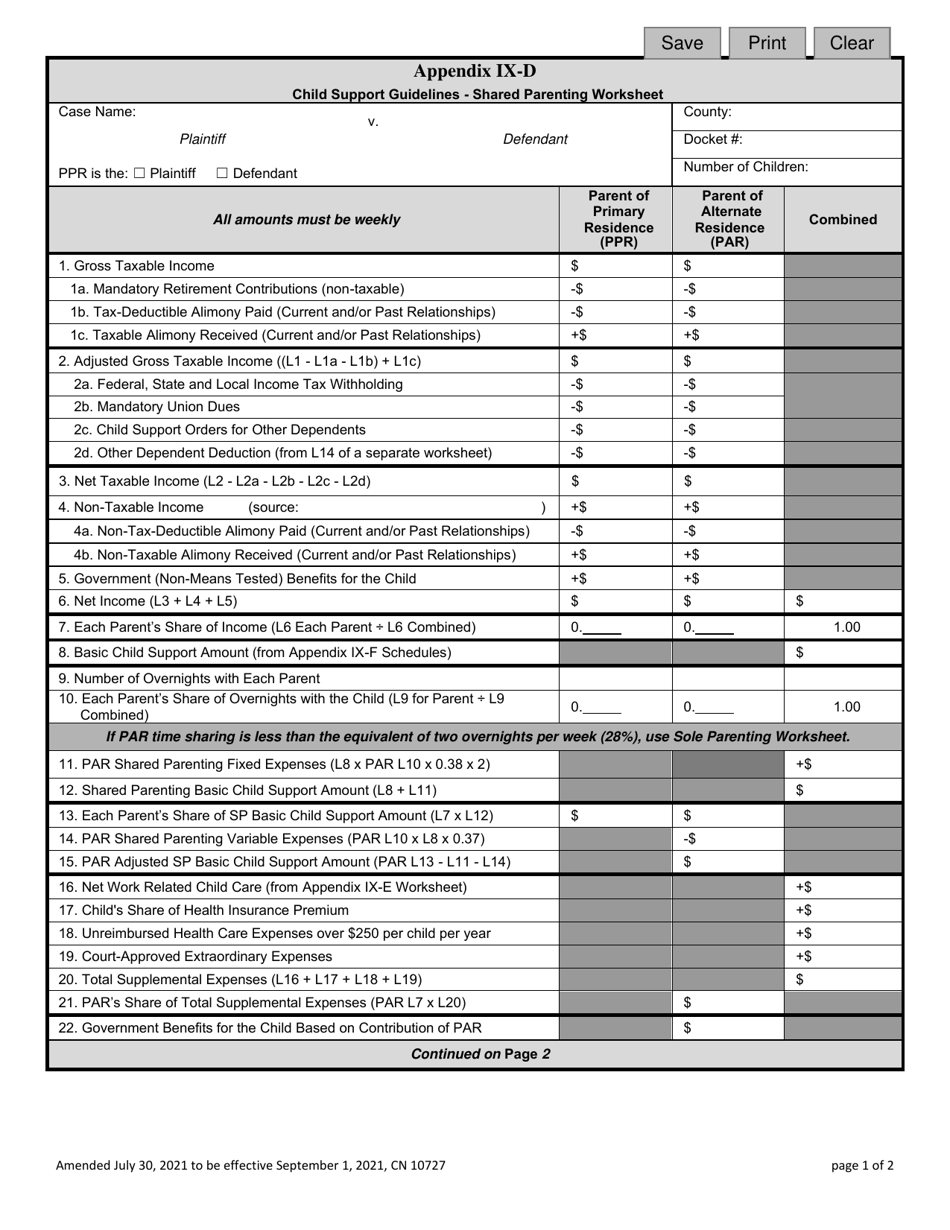

Form 10727 Appendix Ix D Download Fillable Pdf Or Fill Online Child Support Guidelines Shared Parenting Worksheet New Jersey Templateroller

Union Dues Statements Iuoe Local 139

Solved Mulry Had The Following Data From His Employment In 2018 Monthly Salary P12 000 Taxes Withheld 8 000 Pag Ibig Fund Contributions 1 500 Unio Course Hero

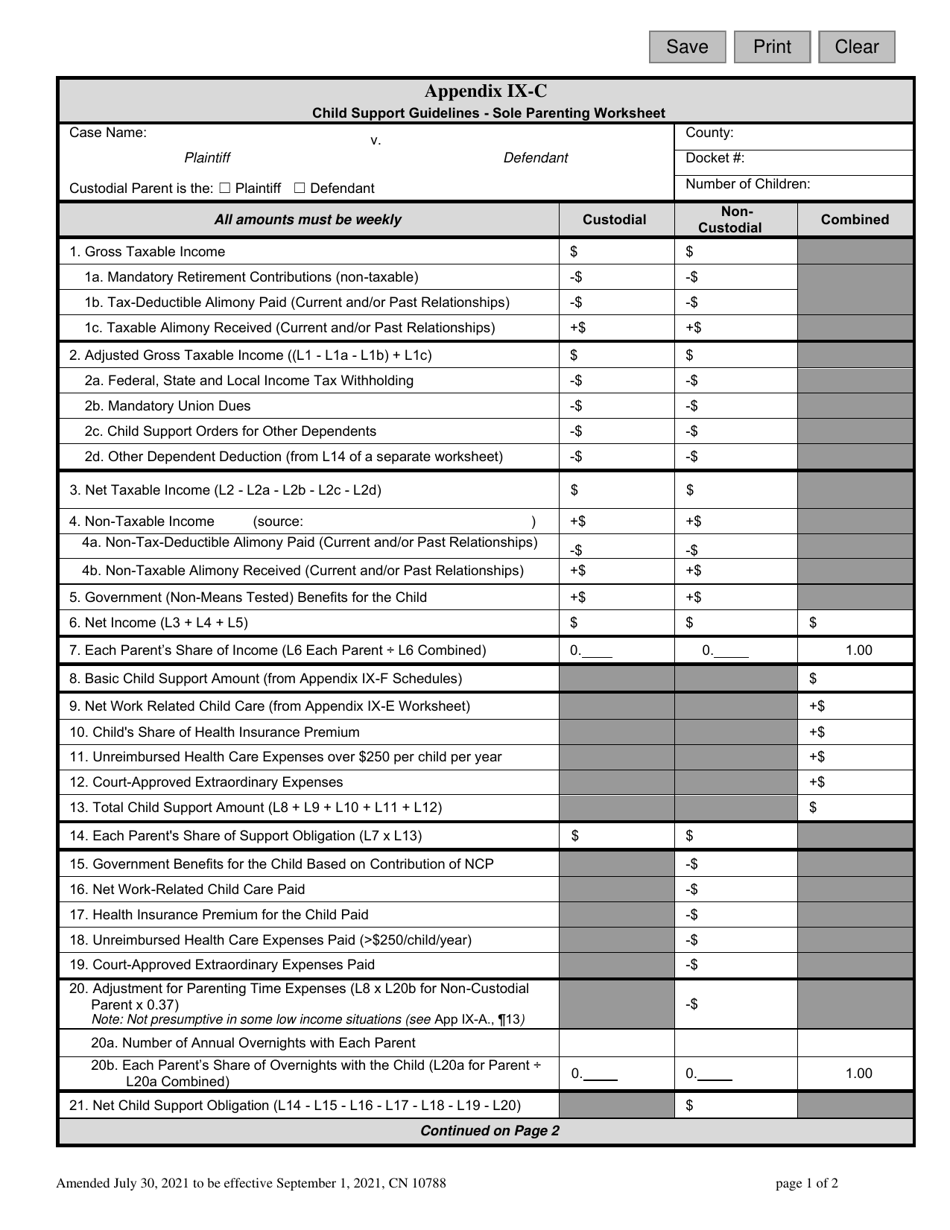

Form 10788 Appendix Ix C Download Fillable Pdf Or Fill Online Child Support Guidelines Sole Parenting Worksheet New Jersey Templateroller

2020 W 2 Now Available For Printing District 99

Membership Dues Tax Deduction Info Teachers Association Of Long Beach

Bill Seeks To Make Union Dues Tax Deductible Iam District 141